This team of professionals can help Finance Strategists maintain the highest degree of precision and professionalism probable.

If you don’t decide a single and don’t have already got a super account, then your employer will open 1 for yourself.

Superannuation, often known as "Tremendous," is really a Obligatory pension method in Australia. It will involve companies contributing a proportion of the employee's earnings into a superannuation fund, that is then invested to offer retirement Advantages for the employee.

They may help you fully grasp the complexities of superannuation and make educated conclusions To optimize your retirement personal savings.

So, we're carrying out items a bit in a different way on this episode of Super Insider. We have got April Smith and Kane Everingham from our instruction staff answering a number of the most often asked inquiries from our members and other people while in the community about what they need to know about Tremendous. So, for now, I am handing it more than to Kane and April.

Accumulation money are distributed to retirees determined by the returns produced, so the greater you place into your fund and the greater it grows, the greater you could acquire in retirement.

should you be self-employed, you're not legally needed to fork out you the super assure. nevertheless, It can be absolutely a good idea to fork out on your own normal Tremendous contributions to ensure you have ample retirement cost savings. You can make contributions into your super fund the same as a regular lender transfer.

Index money are designed for lengthy-expression investing, so How come most Tremendous money in Australia do the job in different ways?

The cash with your super fund is then invested into a variety of different belongings like shares, commodities, home and dollars on your behalf by the Tremendous fund expenditure workforce.

Finder may well receive remuneration from your supplier should you click the connected connection, acquire or enquire in regards to the product. Finder's determination to show a 'promoted' item is neither a recommendation the item is appropriate for you nor a sign that the products is the best in its class. We motivate you to use the resources and information we provide to check your choices. wherever our internet site back links to individual items or shows 'drop by internet site' buttons, we may receive a Fee, referral cost or payment when you click on All those buttons or submit an application for a product. you may find out more regarding how we earn money. Sorting and position Products When items are grouped in a table or list, the purchase during which They may be initially sorted could possibly be influenced by A selection of aspects such as cost, charges and special discounts; business partnerships; solution attributes; and model popularity. We provide applications so that you can sort and filter these lists to focus on attributes that subject to you. Terms of company and privateness coverage be sure to examine our Web-site terms of use and privateness coverage for more information about our solutions and our approach to privateness.

Your super fund's financial investment returns can significantly influence your retirement discounts. It can be important to be aware of your chance profile and be certain your Tremendous is invested in a means that aligns together with your retirement objectives and risk tolerance.

You are qualified to receive superannuation assurance payments out of your employer if you meet up with all of the next:

will not enter particular info (eg. surname, phone number, lender information) as your issue will likely be produced general public finder.com.au is actually a economic comparison and data services, not a financial institution or solution service provider We simply cannot offer you personalized website tips or suggestions Your remedy may well presently be waiting around – Verify earlier inquiries under to see if yours has presently been questioned I acknowledge Your question

How should you draw on the Tremendous when you retire? How long will super have to previous for? And How will you most effective make full use of it?

Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Talia Balsam Then & Now!

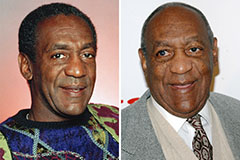

Talia Balsam Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!